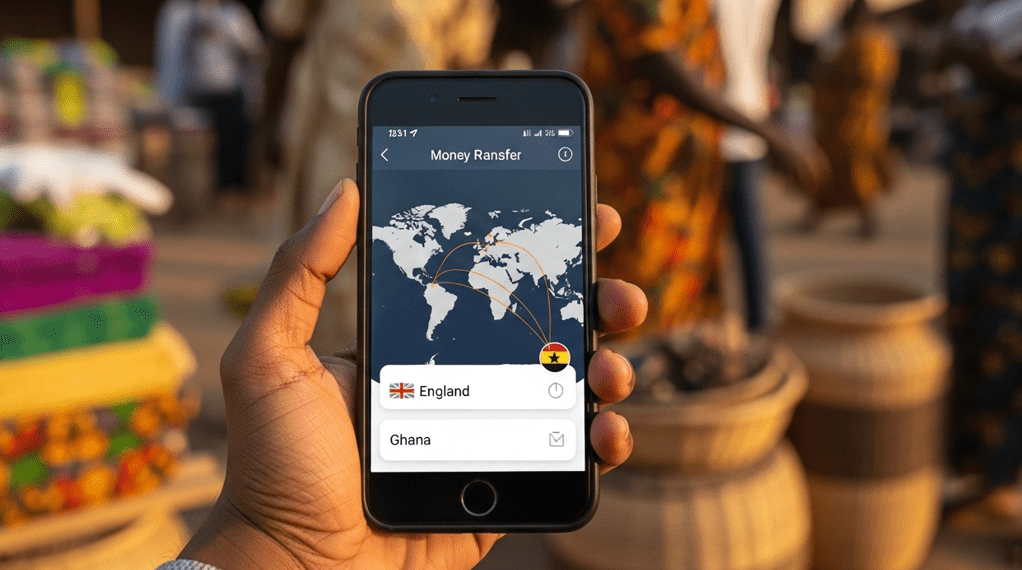

Ever tried to remit funds from England to Ghana only to face unexpected delays, hidden fees, or frustrating complications? When sending money across borders, what should be a straightforward transaction often becomes an exercise in patience and problem-solving.

Unfortunately, many traditional money transfer services leave senders wondering when—or if—their money will arrive safely. Thankfully, there are better options available today. DexRemit was specifically designed to transform this experience, making international transfers fast, predictable, and stress-free. With real-time exchange rates and rapid delivery through Ghana’s trusted mobile wallet network, you can now send money with complete confidence that every pound reaches its destination securely.

In this comprehensive guide, we’ll walk you through the entire process of safely transferring money from the UK to Ghana. From choosing the right service to understanding exchange rates and avoiding common pitfalls, we’ve got you covered with practical advice for your next international transfer.

Choosing the Right Way to Remit Funds from England to Ghana

Transferring money internationally requires careful consideration of available options. While traditional banks have long been the go-to choice for sending funds abroad, modern digital platforms have created more efficient alternatives for those looking to remit funds from England to Ghana.

Bank transfers vs. online platforms

Traditional bank transfers offer security but often come with significant drawbacks. Major UK banks typically charge higher fees and provide less favorable exchange rates compared to specialized services. Furthermore, bank transfers can take several days to process, requiring recipients to have an existing bank account in Ghana.

In contrast, online money transfer platforms like Wise, WorldRemit, and Revolut have transformed international transfers by offering more competitive rates, lower fees, and faster delivery times. These digital services enable users to send money directly from UK bank accounts to Ghanaian banks or mobile wallets—often within minutes rather than days.

What to look for in a remittance service

When selecting a remittance service, several factors deserve your attention:

- Security: Both consumers and SMEs rank security as the primary consideration when choosing a payment provider.

- Transparency: About 70% of consumers and SMEs would abandon a provider after experiencing hidden fees—a stronger reaction than if a payment failed to arrive altogether.

- Exchange rates: Even small differences in GBP to GHS exchange rates can significantly impact the final amount received.

- Transfer speed: Consider whether your recipient needs funds immediately or can wait a few days for potentially lower fees.

- Receiving options: Ensure the service offers your recipient’s preferred method—bank deposit, mobile wallet, or cash pickup.

Why speed and transparency matter

In today’s digital environment, expectations for international transfers have evolved dramatically. About 79% of consumers and 76% of SMEs now expect international payments to be completed within one hour or less. Though only 24% of consumers demand instant transfers, this expectation continues to rise as domestic payment systems increasingly move toward real-time processing.

Transparency has become equally crucial. Without clear tracking and fee structures, customers quickly lose confidence and switch providers. Modern services now offer real-time tracking similar to package delivery services, eliminating uncertainty and building trust.

How the Transfer Process Works

Sending money to Ghana follows a systematic process across most reputable transfer services. Understanding each step ensures your funds arrive safely and efficiently when you remit funds from England to Ghana.

Step 1: Create your account

Initially, you’ll need to register with your chosen money transfer service. This straightforward process typically requires your email address, a strong password, and verification of your identity. Most services offer registration through their website or mobile app. During this stage, you’ll provide basic personal information, address details, and possibly upload identification documents for verification purposes.

Step 2: Enter recipient details

Subsequently, you must input accurate information about your recipient. The required details vary based on your chosen delivery method:

- For bank transfers: Full name (English characters only), bank name, and account number (8-20 digits long)

- For mobile wallets: Recipient’s phone number registered to services like MTN Mobile Money or Vodafone Cash

- For cash pickup: Recipient’s full name and sometimes their address

Step 3: Confirm exchange rate and fees

Before finalizing, review the complete transaction details. Reputable services display their fees upfront along with the exact amount your recipient will receive. This transparency allows you to calculate the total cost before proceeding. Moreover, some services offer calculators to estimate costs and see current exchange rates.

Step 4: Make the payment

Afterward, select your preferred payment method. Options generally include:

- Bank transfers (usually the cheapest but potentially slower)

- Debit or credit cards (faster processing)

- Mobile payment options like Apple Pay or Google Pay

Step 5: Track your transfer

Finally, once payment is submitted, you’ll receive a reference number or tracking code. Most services provide real-time tracking through their website or app. Many transfers to Ghana arrive within minutes, although bank transfers may take 1-3 business days depending on the service. The recipient receives notification when funds arrive, allowing immediate access through their selected method.

Understanding Exchange Rates and Timing

Exchange rate fluctuations can dramatically impact the value of your money when you remit funds from England to Ghana. Understanding these variations helps maximize the amount your recipients receive in Ghana cedis (GHS).

How GBP to GHS rates affect your transfer

The British pound to Ghanaian cedi exchange rate directly determines how much money reaches your recipient. Even minor rate differences significantly impact the final amount. For instance, a small 1% fluctuation could cost thousands on substantial transfers. The GBP/GHS rate varies constantly due to multiple factors, including:

- Economic performance in both countries

- Interest rates and inflation levels

- Political stability and policy changes

- Global commodity prices (especially relevant for Ghana’s gold, cocoa, and oil exports)

Currently, 1 British pound equals approximately 14.7041 GHS, yet this figure changes daily. Over the past six months, this rate has fluctuated between a high of 16.9905 GHS (October 7, 2025) and a low of 13.8684 GHS (August 1, 2025).

When is the best time to send money?

Timing your transfer strategically can yield better rates and lower fees. Many people instinctively send money immediately after receiving their salary—typically during the last five days and first ten days of each month. Unfortunately, this creates peak periods when fees may increase and exchange rates might be less favorable.

Consider instead:

- Mid-month transfers to avoid crowds and potential fee spikes

- Mondays, which often experience the lowest trading volumes and minimal price fluctuations

- Weekends, which typically see fewer transfers and potentially better rates

Using real-time rate tools

Several services offer tools to help track and optimize your transfers:

Rate alerts notify you when exchange rates reach your desired level, allowing you to time transfers advantageously. Historical rate charts help identify patterns and trends in currency movements. Some platforms employ real-time tracking systems that automatically match interbank benchmarks, preventing hidden margins traditionally embedded in currency conversions.

Remember that the interbank rate (sometimes called the mid-market rate) represents what banks use when trading with each other—not what’s available to individuals. The rate you receive will include a margin, which is how currency providers earn revenue.

Safety, Support, and First-Time User Tips

Safety remains paramount when sending money abroad, particularly when you remit funds from England to Ghana. Ensuring your transfer arrives securely requires attention to several critical factors.

How secure are online money transfers?

Reputable online transfer services employ robust security measures to protect your transactions. These typically include encryption technology, fraud protection systems, and authentication features like two-factor verification. Many services are regulated by financial authorities such as the UK’s Financial Conduct Authority (FCA) and comply with industry security standards.

Nonetheless, caution is essential as scammers continuously develop new tactics. Be immediately suspicious if you’re asked to wire money through unusual channels, rushed into transferring funds, or requested to share passwords or personal information.

What support is available if something goes wrong?

Should problems arise with your transfer, most providers offer multiple support channels. Many services provide:

- 24/7 customer assistance through in-app support

- Phone support with dedicated teams

- Email contact options

If issues remain unresolved after contacting your provider, you can escalate complaints to the Financial Ombudsman Service. When transfers go to the wrong recipient, contact your service provider immediately—some offer protection periods of up to 36 months for claims, albeit earlier reporting increases recovery chances.

Tips for first-time users to avoid mistakes

First-time users should:

- Double-check all recipient details before confirming transfers

- Verify the service is legally registered and properly regulated

- Track your transfer using provided reference numbers

- Never send cash through postal services

- Store card details securely in the provider’s system rather than entering them repeatedly

Conclusion

Remitting funds from England to Ghana has certainly evolved beyond the traditional banking methods that once dominated international transfers. Throughout this guide, we’ve explored how digital platforms have transformed this process, making it faster, more transparent, and considerably more affordable than conventional bank transfers.

Above all, security remains the primary consideration when sending money internationally. Therefore, choosing a regulated service like DexRemit that employs robust encryption and verification measures protects both your funds and personal information. Additionally, the transparency offered by modern transfer services eliminates the uncertainty that once plagued international money transfers.

Exchange rates undoubtedly play a crucial role in determining how much money actually reaches your recipients. By monitoring rate fluctuations and timing your transfers strategically, you can maximize the value of every pound sent to Ghana. Furthermore, the speed of modern transfers means your loved ones or business partners can receive funds within minutes rather than waiting days.

The step-by-step process we’ve outlined simplifies what was once a complex procedure. From creating your account to tracking your transfer in real-time, these platforms have streamlined international money movement. Nevertheless, always double-check recipient details before confirming any transaction to avoid costly mistakes.

Whether you’re supporting family, paying for services, or conducting business in Ghana, safe and efficient money transfers are now within reach. As a result, you can enjoy peace of mind knowing your money will arrive securely and promptly. The days of wondering about hidden fees or unexpected delays are finally behind us, thanks to specialized services designed specifically for this important corridor.

Remember, the best remittance service is one that balances security, speed, transparent fees, and competitive exchange rates. With these considerations in mind, you can confidently remit funds from England to Ghana without the stress and uncertainty that once defined international transfers.